Curious about UTT? Learn what it is, how it works, and how to begin investing in it.

You may have heard of UTT but don’t understand what people are talking about…

Or you know that UTT has different funds but don’t know what these funds are for.

When you read to the end,

you will be able to understand exactly what UTT is, and how different its funds are.

But starting with investments…

Investing is using the money you have saved to generate more money (profit).

One way to invest collectively with other investors then sharing the profits. This kind of investment is what we call Mutual Funds.

UTT-AMIS (Unit Trust of Tanzania – Asset Management and Investor Services),

is a government owned institution under the Ministry of Finance of joint-investment in Tanzania, established in 2003.

How UTT Works in Tanzania?

When investors’ money is collected, the funds are invested in other liquid assets such as Bonds, Stocks and Call Accounts.

The investment is made by investment professionals, and this is one of the biggest benefits of investing in mutual funds.

Bonds Investments often start at 1,000,000/= and when you invest in Stocks, you need to monitor it yourself.

But not everyone can have 1,000,000/= to invest in Bonds and not everyone has the time and expertise to keep track of stocks,…

so mutual funds come in handy in this type of situation.

The UTT Mutual Funds promise a return of at least 12% per year or at least 1% per month.

For example;

When you invest or save 100,000/= today, within a year it can grow up to 112,000/=

But it’s also good to know that,

…any type of investment comes with a risk of loss because the financial market is affected by what is happening,

in the national and global economy.

The Mutual Funds of UTT

UTT has 6 funds;

✔ Watoto Fund

✔ Liquid Fund

✔ Wekeza Maisha Fund

✔ Jikimu Fund

✔ Bond Fund, and

✔ Umoja Fund

| Fund | Benefits | Money Withdraw (Re-purchase)… | Start With (Shillings) |

| Watoto | Capital Growth | When the child reaches 12 years of agee | 10,000/= |

| Liquid | Capital Growth | Within 3 working days | 100,000/= |

| Wekeza Maisha | Capital Growth | After the first 5 years | 8,340/= monthly contribution, or 1,000,000/= |

| Jikimu | Dividend/ Income Generation | Within 10 working days | 5,000/=For capital growth 1,000,000/=For an annual income 2,000,000/=For a quarterly / 3-months income |

| Bond | Dividend/ Income Generation | After the first 3 to 6 months | 50,000/=For capital growth 5,000,000/=For a semi-annual / 6-months income 10,000,000/=For a monthly income |

| Umoja | Capital Growth | Within 10 working days | 10,000/= |

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

And…

If you have a goal to reach a certain amount of money within a period of time, discover what you can invest every month,

…using this tool: UTT Monthly Investment Plan

PS:

You can use UTT Mutual Funds to accumulate savings for your goals :)

Just get started!

Money-ly Yours,

Gracing Money!

References:

1] UTT-AMIS, uttamis.co.tz

2] UTT-AMIS, Investment Assumption Calculator, Monthly Investment Plan

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

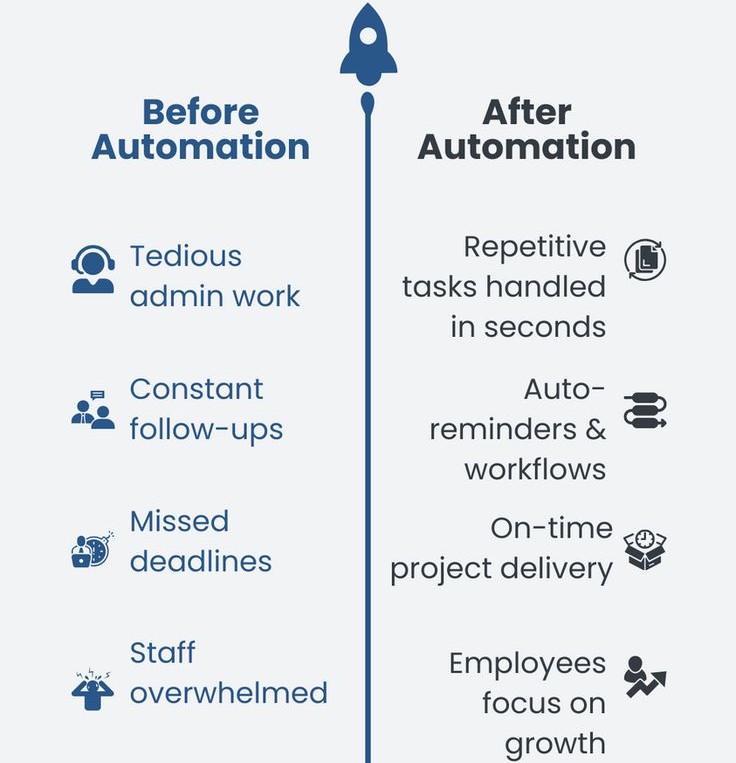

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…