Want to invest safely? This is how to begin with bonds and find out what makes them a smart choice.

Have you heard about bonds and don’t understand how they work?,

…or you want to get started but don’t know how to buy bonds.

If yes is your answer, then this article is for you.

A bond is an investment that involves you lending money to the government or an institution in order to,

earn interest (in form of coupon payments) over a period of time.

The government or institution then receives the money and use it for development or doing business for profit,

…still bearing the responsibility of paying you the coupon/interest.

Types of bonds include;

✔ Government Bonds,

✔ Municipal Bonds,

✔ Corporate Bonds, and

✔ International Bonds.

The Bank of Tanzania (BoT) gives out bonds auction calendar for every half year by June and December,

…on the BoT website, and you can get the list of active corporate bonds on the Dar-es-Salaam (DSE) website.

Coupons, often paid twice a year for government bonds is one of the benefits of bond investing.

Other benefits of investing in bonds include;

✔ Using a bond as collateral to get a loan

✔ Investing with less risk of loss, and

✔ You can preserve money for a period of time.

7 Important Steps to Start Investing in Bonds

- Get the correct understanding about Bonds

…through books, seminars, brokers or other knowledgeable financial experts.

This will help you determine the best interest rates and the prices to buy bonds in order to get a good return/profit.

The interest rate normally increases with the investment period.

2. Have the investment amount to begin with

The minimum investment amount ranges from 500,000/= to 1,000,000/= and if,

…you want to buy bonds but you don’t have this amount, you can choose to invest in Mutual Funds which,

invest in bonds, alongside with other investors.

3. Choose a broker or a dealer you will work with.

You cannot buy or sell bonds as an individual or even an institution.

A broker is an agent who buys and sells bonds on your behalf, and

A dealer is an agent who buys and sells bonds on his own behalf, that is, he can sell you bonds on the secondary market (DSE).

You can get the full list of licensed brokers and dealers on the DSE website.

4. Open your CDS (Central Depository System) Account

…through your broker, and

5. Buy Bonds

…on an auction on the primary market or,

buy bonds that has previously been bought and resold on the secondary market (DSE).

6. You will get a proof of purchase

…known as the relevant bond seller, and

7. You will follow up your coupon payments

…on the dates stated by the bond seller and you can keep track of your bond investments.

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

You can also buy bonds through Mutual Funds which,

…invests in bonds, alongside other investors. A good example being, the Bond Fund of UTT-AMIS.

Money-ly Yours,

Gracing Money!

References:

1] Bank of Tanzania, bot.go.tz

2] Dar-es-Salaam Stock Exchange, dse.co.tz

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

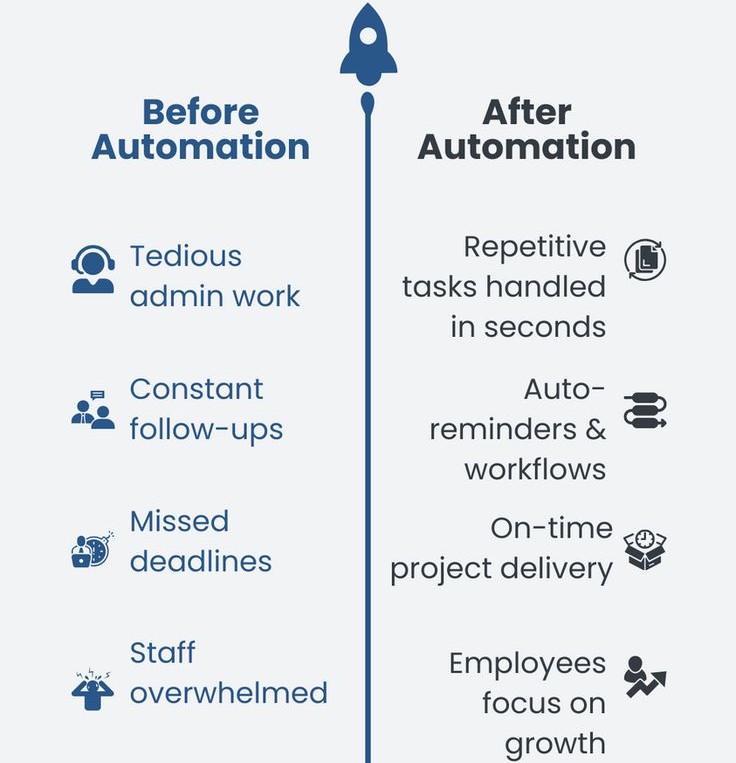

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…