A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way

You’ve been hearing about investing a lot lately, but…

You are a Muslim and would like to save and invest in a way that is aligned with your belief, your Iman.

There are stakeholders in the Financial Market who thought about you.

Islamic Financial Products primarily consider;

✔ Rules of Shariah in the investments and transactions that take place,

✔ Distribution of Risk between the borrower and the lender,

And ensuring…

✔ Access to Financial Services to those who consider conventional banking and financial services to be incompatible with religious principles.

The Islamic Saving Products for you, are;

✔ Islamic Savings Account

This is no different from a regular savings account, except that it works on the principle of profit sharing, not interest.

✔ Mudarabah Account

One side gives capital and another side (that is you) provides the expertise, and then profit on a predetermined ratio.

And,

✔ Wadi’ah Account

This account aims at protecting your capital rather than making profit.

Islamic Investment Products for you, are;

✔ Sukuk (Islamic Bonds)

You earn an income, the coupon payments, based on the profit earned and not interest.

A good example is the KCB Sukuk Bond and two (2) Sukuk Bonds of The Revolutionary Government of Zanzibar (one in TZS Shillings and another in US Dollars – $).

✔ Mudarabah (Profit Sharing)

One side gives capital and another side (that is you) provides the expertise, and then profit on a predetermined ratio.

✔ Musharakah (Joint Venture)

Often used in real estate.

Different people or institutions partner to contribute capital for a project and then share the profits or losses based on the ratio of contribution.

✔ Murabaha (Cost-Plus Financing)

The bank buys an asset for you and sells it at a profit. You, then pay it back in installments, alongside the profit.

✔ Lease Financing

You are given a lease and you pay it back as rent. The ownership becomes yours when the rental period ends.

Are these financial instruments only for Muslims?

Nope…

Except that all prerequisites related to that service must be adhered to.

Visit your banking institution to find out which Islamic savings and investment assets they offer, or…

Visit Islamic Bank institutions such as AMANA Bank and CRDB Al Baraka.

Which mutual funds can you start to invest in?

There is Alpha Halal Fund by Alpha Capital Limited and iImaan Fund by iTrust Finance Limited.

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

You still have the opportunity to participate in the Financial Market, as a Muslim, so save and invest with confidence.

Do start today!

Money-ly Yours,

Gracing Money!

References:

1] CRDB AlBarakah Banking,https://crdbbank.co.tz/en/for-you/al-barakah-banking

2] AMANA Bank | Islamic Bank in Tanzania, https://www.amanabank.co.tz/

3] Financial Educator Certification, Covenant Institute of Tanzania and Bank of Tanzania (BOT)

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

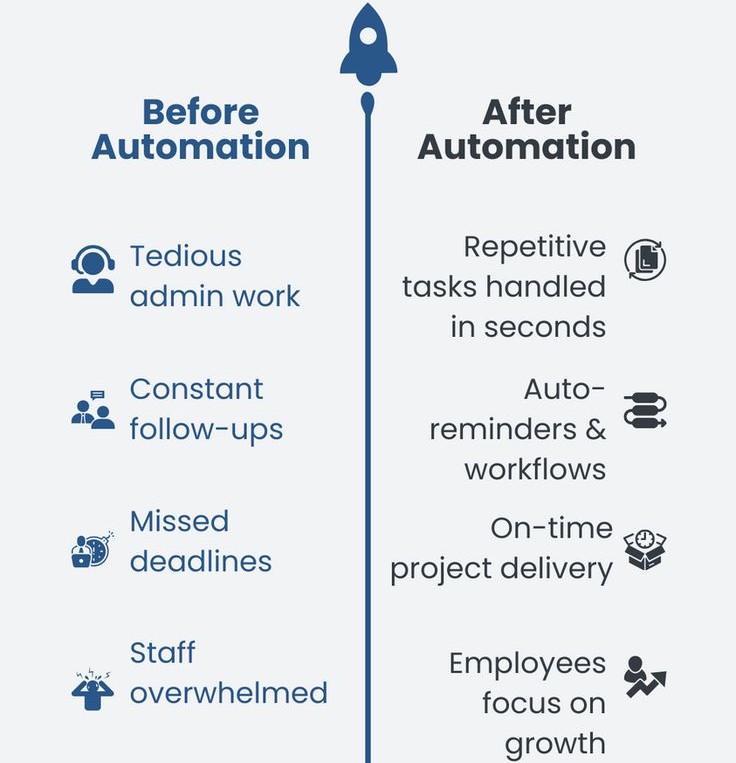

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…