Want a fresh way to think about money? These 5 powerful books will change how you think about earning, saving, and growing your finances.

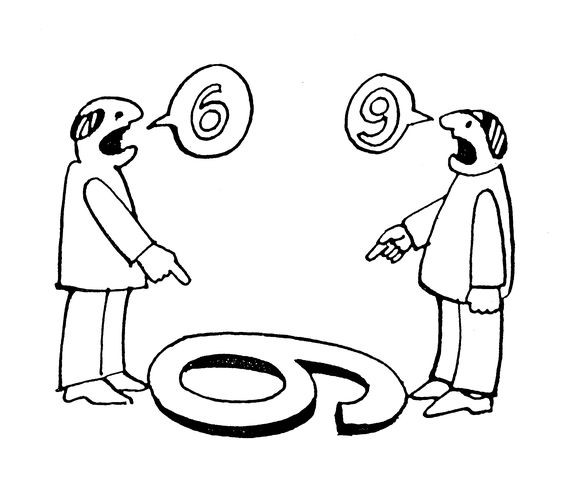

6 and 9 are exactly the same…

depending on which side you are standing.

The things we give importance to in life are very much dependent on what we believe,…

the way we see things, our perspectives. The same goes for our money mindsets.

There are books you read, and when a person asks you about it the next day,

…your answer may be very short, maybe like 2 sentences.

Then there is a book you read and want to repeat it.

And without even being asked, you are ready to talk about it, or even decide to buy it as a gift for someone else.

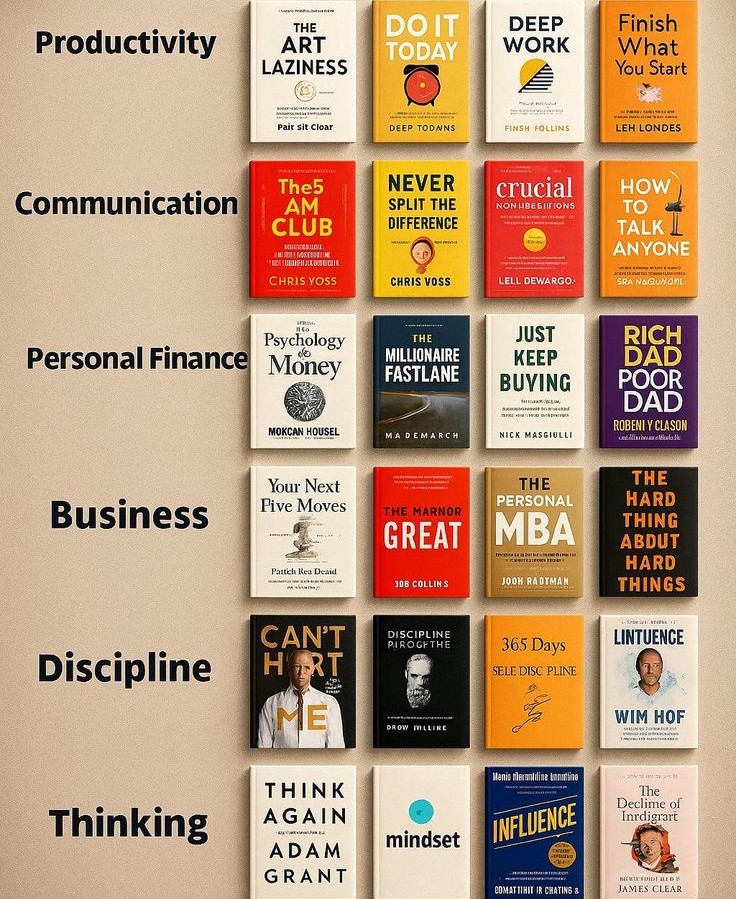

These recommended financial books to read, will make you want to talk about them. Starting with;

1. The Richest Man in Babylon / Tajiri wa Babeli

This book was written by a businessman, George S. Clason, and was published in 1926.

Until now it has been translated in about 32 different languages.

It is a book that uses stories from ancient times, in a city called Babylon, to show the principles of personal finance such as;

✔ saving money,

✔ paying off debts,

✔ preparing for opportunities,

✔ increasing income,

✔ investing, and

✔ being wary of quick-money schemes.

‘gold comes in abundance to the one who saves one tenth

of his income, and use the savings to invest for the future’

2. Rich Dad, Poor Dad

This book was written by a businessman, Robert Kiyosaki, and published in 1997. Until now, it has been translated into more than 50 languages.

Robert uses a story where he has 2 fathers; his biological father who is poor and his friend’s father who is rich.

It’s not that his father didn’t have money. His father was educated and employed, but

…he did not have the mindset to build generational wealth.

And would not come from depending on his salary. In his book, Robert showed the importance of,

✔ building assets,

✔ having financial knowledge, which is never taught in schools,

✔ building a business,

✔ making investments,

✔ having passive income, and

✔ having a positive money mindset.

3. The Psychology of Money

This book was written by Morgan Housley, published in 2020.

It is a book about the people’s mindsets behind wealth, desire, and happiness. It shows important things like;

✔ financial success involving more of behavior than intelligence,

✔ the difference between being rich and staying rich,

✔ expensive things showing consumption rather than wealth,

✔ wealth not being a product of someone making little or no mistakes,

✔ giving yourself the opportunity to make mistakes, and

✔ respecting the power of time in investing.

4. Maamuzi Juu ya Fedha Inayopita Mkononi Mwako Yaweza Kukufanya Uwe Tajiri au Maskini

It is a book written by a Bible teacher, Christopher Mwakasege, and it was published in 2016.

It is a book that uses biblical principles to emphasize the importance of making the right money decisions with every money you get.

And that it is the money that you earn that will make you rich or poor.

The book highlights the importance of;

✔ saving,

✔ not spending more than you earn,

✔ creating multiple sources of income,

✔ investing,

✔ not underestimating what we call ‘little’ money and

✔ avoiding financial mistakes.

5. Kustaafu

It is a book written by an investor, Emilian Busara, which describes the preparation towards retirement, especially for employees,

…and that retirement is not for the elderly alone.

When anyone starts a job, they should know from the beginning that their journey will have an end and they should prepare for it.

Other important highlights include like;

✔ the importance of staying healthy,

✔ building sustainable income,

✔ pension payments,

✔ things to do after retirement,

✔ retirement with goals, and

✔ maintaining relationships with the community.

And if you want to know how to start with amending your personal finances, you can read here.

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

6 and 9 are similar, depending on your mind positioning.

Having a positive mindset about money will help you make decisions that will elevate you.

Money-ly Yours,

Gracing Money!

References:

1] The Richest Man in Babylon, George S. Clason

2] Rich Dad Poor Dad, Robert Kiyosaki

3] The Psychology of Money, Morgan Housley

4] Maamuzi Juu ya Fedha, Christopher Mwakasege

5] Kustaafu, Emilian Busara

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

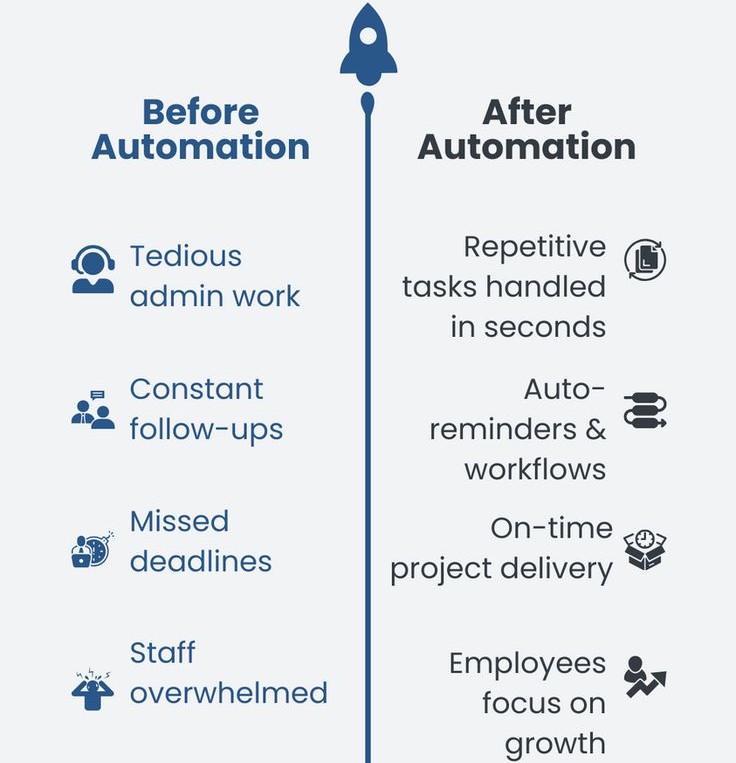

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…