Read this before picking the mutual fund, among many out there, that matches your financial goals. It’s not as confusing as you think.

You have heard about multiple mutual funds,

…and don’t know how to choose the right investment fund.

If this is you, by the end of this message, you will have the answers you have been looking for.

But, start here if you have never heard of mutual funds.

There are more than 15 mutual funds, some of them including;

✔ Umoja Fund (UTT Amis)

✔ Watoto Fund (UTT Amis)

✔ Bond Fund (UTT Amis)

✔ Liquid Fund (UTT Amis)

✔ Faida Fund

✔ M-Wekeza, and

✔ Sanlam Pesa Money Market Fund

Mutual funds are differentiated by their unique benefits, which makes the important question to be,

What is your goal/intention?

This is one simple question that if answered, will make your choice easy.

The first thing to know;

1. The Kind of Profit the Fund Generates

The two (2) main advantages of mutual funds are Capital Gain and Dividend Income.

This means that the fund you are looking for either focuses on;

…raising capital or paying back an income.

Of the 7 examples of funds mentioned above, Watoto Fund and Umoja Fund give capital gain and Bond Fund pays back an income.

Secondly,

2. Unique Benefits of the Fund

The fund may be raising capital or generating income but can have a special benefit that you don’t need.

Example;

Watoto Fund directly benefits children. Therefore, you may want capital gain but the fund would not be fit for you.

Wekeza Maisha Fund grows your capital but won’t be able to withdraw your funds for the first 5 years.

This fund benefits more those who are preparing to retire.

Bond Fund gives a dividend/an income in a monthly plan or semi-annual plan, which means…

…if you want quarterly dividends, you would have to choose another fund.

3. The Minimum Amount to Invest

It is important to know the minimum investment amount for that respective fund.

The minimum amount for mutual funds such as Umoja, Watoto, Faida, M-Wekeza is 10,000/=, 50,000/= for the Bond Fund…

100,000/= (for Liquid and iCash Funds), all depending on the type of income it provides, whether it is an income or capital growth.

4. Investment Period

You can choose a fund that matches the time you want to invest, if it is short term or long term.

Lock-in Period:

Mutual Funds like Faida, Watoto and Wekeza Maisha can take from 3 months to 5 years of restricted withdrawal of funds.

So before choosing a fund, decide if you will not need to withdraw money during the entire period of investment.

Lastly,

5. The Ease of Cashing Out (Liquidity)

Apart from the lock-in period,

You should know how long it will take for you to get your funds after the application to withdraw money,…

How much time is convenient for you?

Which fund is right for you when you need money quickly?

Withdrawal time can range from 3 to 10 working days (example, the Liquid Fund, Umoja, and Timiza) or

an instant withdrawal from M-Wekeza (by Vodacom na Sanlam Investments).

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

Your goals make your journey to financial freedom easier.

Start today!

Money-ly Yours,

Gracing Money!

Marejeo:

1] UTT-AMIS, uttamis.co.tz

2] Watumishi Housing Investment, whi.go.tz

3] M-Wekeza, vodacom.co.tz

4] Sanlam Pesa Money Market Fund, invest-tz.sanlameastafrica.com

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

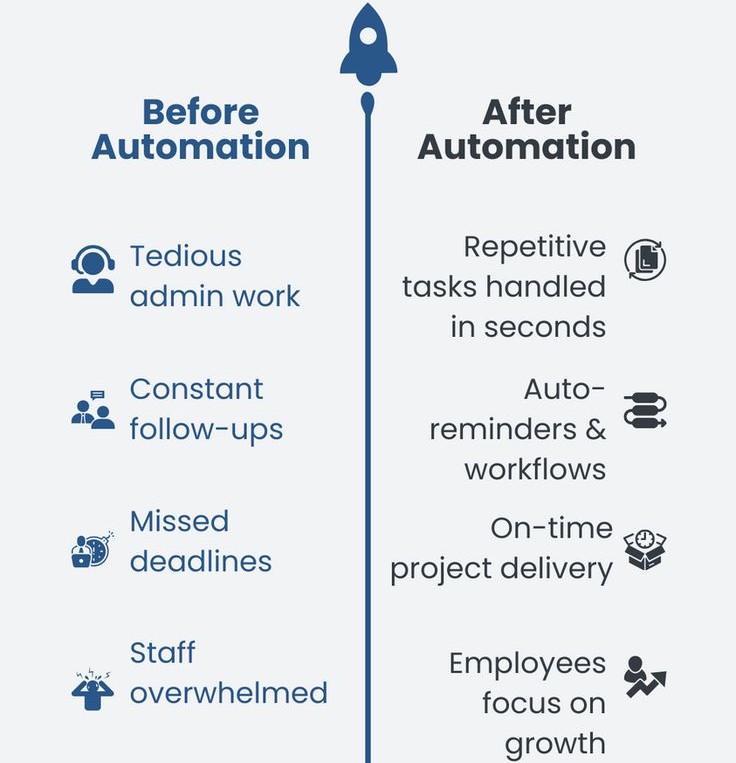

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…