Think you need a lot of money to invest? Wrong! Here’s how to begin your investment journey with just 10,000/=.

Have you ever wanted to invest but thought that you require a big amount to start?

If your answer is yes, read through to the end of this message.

A 26-year-old Emmanuel had the tendency of saving money. He kept some of his savings in the bank, and a portion of it, at home.

But, whenever Emmanuel collected a significant amount, he spent it because he always knew ‘there is money at home’…

…and after using a huge portion of it, he had to start saving again.

The amount Emmanuel kept in the bank was slightly decreasing; the monthly costs, ATM withdrawal costs,…

…so he decided to find an alternative way.

Then he heard about mutual funds, and decided to inquire further only to realize that…

✔ he could start with a small amount,

✔ his money had the potential to grow,

✔ he could withdraw his money without significant deductions, and

✔ he could start saving at any time he wanted to do so.

So he didn’t waste time and opened his first mutual fund account.

Before we continue,…

Saving is simply putting a portion of your money away but Investing is allocating your collected funds to make more money (profit).

So then,

Mutual Funds is the kind of investment whereby many people invest collectively and is managed by investment professionals.

The money collected by mutual funds is invested in the Financial Market to generate profit which is later distributed to investors.

Funds like these promise a return of your money up to 12% per annum…

although you shouldn’t forget that every money investment involves a ‘risk’ of losing money.

So, you can count on your money increasing instead of decreasing.

There are more than 15 mutual funds in Tanzania, some of them including;

✔ Umoja Fund (UTT Amis)

✔ Watoto Fund (UTT Amis)

✔ Bond Fund (UTT Amis)

✔ Liquid Fund (UTT Amis)

✔ Faida Fund

✔ M-Wekeza, and

✔ Sanlam Pesa Money Market Fund

Apart from,

✔ a promised rate of return (profit)

✔ professional management, and

✔ many funds to choose from…

With mutual funds,

- You can open your account on mobile and register easily,

- You can get your money immediately to within 3 working days depending on the fund of your choice,

- You can save your money your long-term goals, and even

- Other monetary goals.

Many funds have enabled investors to keep track of their investments on mobile.

If you want to know how to choose a fund that will suit your goals, you can read here.

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

Don’t forget that every long journey, including financial freedom, begins with one step, and this can be your first step.

Get started today!

Money-ly Yours,

Gracing Money!

Marejeo:

1] UTT AMIS, Investment Assumption Calculator, Monthly Investment Plan

2] UTT-AMIS, uttamis.co.tz

3] Watumishi Housing Investment, whi.go.tz

4] M-Wekeza, vodacom.co.tz

5] Sanlam Pesa Money Market Fund, invest-tz.sanlameastafrica.com

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

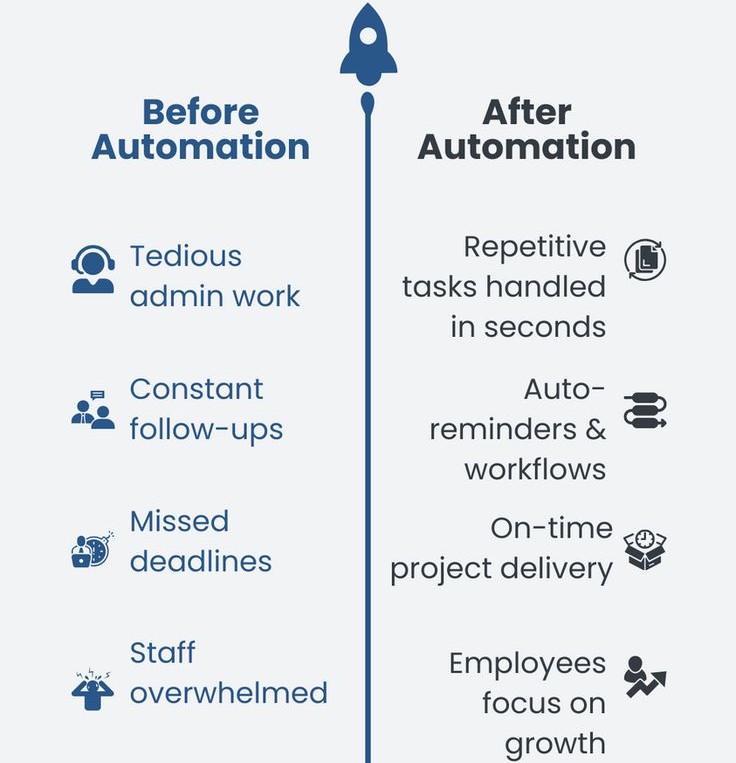

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…