Confused about investing? Discover differences between bonds, stocks, and mutual funds; fast and easy.

You’ve probably heard of investing, or

Or people talking about bonds, stocks, and mutual funds,…

and you are wondering ‘Which investment is right for me?’ .

If this is you, at the end of this message you will discover the important differences, and you will easily choose where to start.

So investing,…

is putting to use the money you have saved to generate profit.

And the first basic question would be;

What are Stocks, Bonds, and Mutual Funds?

Stocks is the ownership part of a company or business.

The ownership of that company is divided into multiple units called shares, and are sold at a price respective to that company (stock price).

Examples of Tanzanian companies that sell shares are CRDB Bank, NMB Bank, and Tanzania Portland Cement (Twiga Cement -TPCC).

A bond is the kind of investment that involves you lending money to the government or an institution to earn interest over a period of time.

The government or institution then uses the money to generate profit via economic ventures and,

…the investor gets his/her money back at the maturity date (when the bond period is over).

Bonds issued by the government are regulated by the Central Bank of Tanzania (BoT) are known as Treasury Bonds.

Other types of bonds include;

✔ Municipal Bonds,

✔ Corporate Bonds, and

✔ International Bonds

Mutual Funds is the kind of investment whereby many people invest collectively and is managed by investment professionals.

The money collected by mutual funds is invested in the Financial Market to generate profit which is later distributed to investors.

Funds like these promise a return of your money up to 12% per annum…

although you shouldn’t forget that every money investment involves a ‘risk’ of losing money.

Examples of mutual funds include,

✔ Umoja Fund (UTT Amis)

✔ Watoto Fund (UTT Amis)

✔ Bond Fund (UTT Amis)

✔ Liquid Fund (UTT Amis)

✔ Faida Fund

✔ M-Wekeza, and

✔ Sanlam Pesa Money Market Fund

Differences between Stocks, Bonds, and Mutual Funds

| STOCKS | BONDS | MUTUAL FUNDS | |

| MEANING | Company Ownership | Lending money to government or institutions | Many investors pool their investment |

| SOLD AS… | Shares, priced by the specific company | Bond Units of 100/= shillings | Units/’Vipande’ (Net Asset Value per Unit) |

| BENEFITS | DividendCapital Gain | Interest PaymentsCapital Gain; depends on the price of purchase or sale | 1. Dividend2. Capital Gain |

| RATE OF RETURN (PROFIT) | The rate depends on the company performance | At least 8.5% for 3-year bonds | Most funds commit to about 12% per year |

| MINIMUM INVESTMENT AMOUNT | 10 Shares of the company you will choose | 500,000/= to 1,000,000/= depending on the type of bond | 10,000/= depending on the fund of your choice |

| INVESTMENT PERIOD | Progressive | Years relevant to the bond | Progressive or Years relevant to other types of funds |

| LIQUIDITY | You can sell when there are buyers in the market | You can sell 2 business days after the purchase is completed | From instantly to 3 working days depending on the fund of your choice |

| RISK OF LOSS | High | Low | Moderate |

| DIVERSIFICATION | The investment is in stocks alone | The investment is in the bond you bought | Investment can be in different assets at the same time |

| COST | Involves tax deductions, brokers commissions, and investment institutions fees | Tax deduction on profit does not apply to bonds over two years | Deductions depend on the specific fund policy |

| PROFESSIONAL MANAGEMENT | You make the investment decisions | You make the investment decisions | Investment professionals make decisions |

| LITERACY BEFORE INVESTMENT | Very much needed | Important | Important |

Now that you know the difference between Bonds, Stocks, and Mutual Funds, you can choose which investment is right for you.

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

Your goals make your journey to financial freedom easier.

Start today!

Money-ly Yours,

Gracing Money!

References:

1] UTT-AMIS, uttamis.co.tz

2] Dar-es-Salaam Stock Exchange, dse.co.tz

3] Bank of Tanzania, bot.go.tz

4] Watumishi Housing Investment, whi.go.tz

5] M-Wekeza, vodacom.co.tz

6] Sanlam Pesa Money Market Fund, invest-tz.sanlameastafrica.com

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

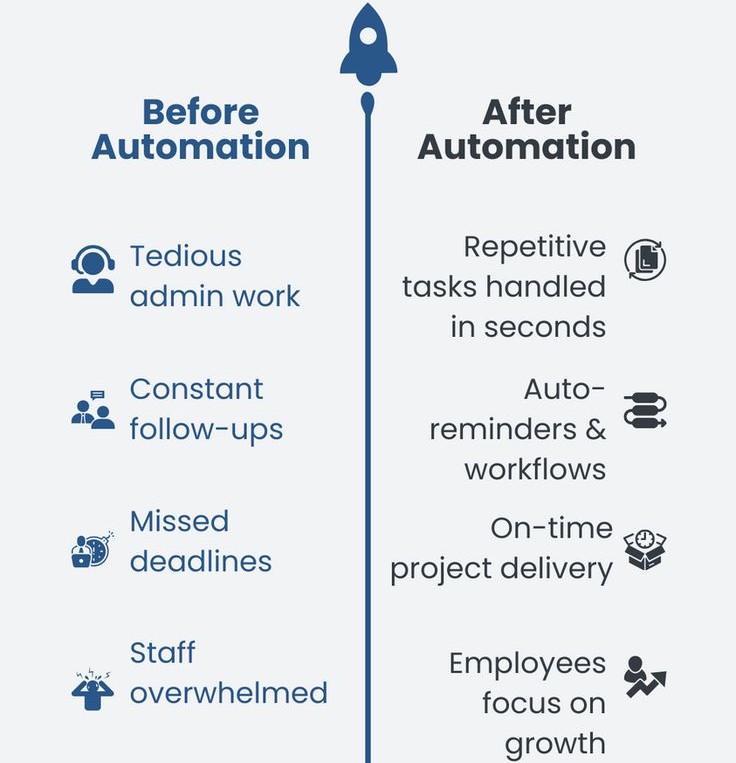

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…