Break free from debt using this simple plan. Practical tips to reduce debt and take charge of your finances.

Are you thinking of re-borrowing to reduce another debt?

Or, do you want to get out of debt but don’t know where to start…

If your answer is yes, then this open letter is for you.

And actually, many people are in this situation. It’s not only you!

The Bank of Tanzania Monthly Economic Report of June 2025 shows that personal loans are the leading form of credit in financial institutions.

In May 2025, personal loans led with 35.7% followed by business (trade) at 13.7%…

This shows us that loans are majorly taken for personal expenses, such as…

✔ health treatments,

✔ funeral expenses,

✔ contributions,

✔ reducing other debts,

✔ schooling/college,

✔ buying cars,

✔ a house constructions,

✔ travel,

✔ leisure and others,

…and less, of economic productivity.

So step one (1) is to;

1. Accept The Debt Situation

The first step in any health treatment is to know and acknowledge the challenge at hand.

Is it a headache, difficulties walking, are there swellings?

If your debts are because of your daily expenses, and you live a life of fear and shame,…

and you don’t see that it’s a problem, then thats another problem.

In this acceptance, list…

✔ all your debts,

✔ the payment interest on those debts (if any), and

✔ your debtors (people or institutions)

Halafu,

2. Meet Your Debtors

…with the same civility you asked for a loan, go back to the people who owe you.

This will help to start rebuilding the trust that may have been lost.

Then you can,

✔ Ask the creditor to give you more time,

✔ or ease the payment terms

with a promise to repay in full whatever required as your ability to earn,

…and fulfill that promise!

If the creditor will refuse the agreement then you would have to agree how to offset the debt at that moment.

3. Find Someone to Hold You Accountable

It may be a spouse, friend, or…

a financial advisor who advised you on how to pay off the debt.

Having the support of someone who cares about you and wants you to succeed, will keep you motivated.

There may be times you may want to give up or face challenges that will cause some sort of financial instability,

…so this will help you not fall back.

4. Have a Debt Repayment Plan

You have to decide which debts you will give priority to, if they are;

✔ small debts first (Debt Snowball Method),

✔ high interest debts first (Debt Avalanche Method), or

✔ you will consolidate all your debts and then take one loan with a lower interest (Debt Consolidation)

Any way that will help you pay your debts in order.

5. Plan Your Budget to Fit Your Debt Repayment Plan

Life must go on; your basic needs, that of family, and other life desires…

therefore, give priority to,

✔ necessary life expenses,

✔ the percentage of your income that goes to reduce the debts, and

✔ start saving, even if in small amounts to help you in times of need

If it is self-denial of some pleasures, it will just be a matter of time.

Then, if you think your income is not enough,

6. Elevate Your Income

Find a way to increase your income funds, in what you are doing at the moment or outside of it.

Know what people want or need, and;

✔ widen your scope in what you already do; is it consulting, working overtime (if they pay overtime, or else it’s useless),…

or add a line of relatable product/service in what you are already doing.

✔ use personal skills; like cooking, crafts, etc.

Just get creative, to reduce the time to pay that debt.

Remember that less income is probably the reason for your being in debt in the first place.

7. Start Your Debt-Free Journey

As you have now started to save, don’t stop learning on better ways to manage your money.

If it is,

✔ reducing non-essential spending,

✔ increase your income,

✔ investing

✔ helping and giving in moderation, etc.

DTI is a ratio that shows the relationship between your monthly debt payments and your income.

You can use the calculator below…

A DTI Ratio,

Less than 36%:

Shows that you can afford to pay off the debts you have and you can save on the amount left after your basic spending.

36% to 50%:

Means there is a need to reduce the debts you have, because you may not be able to afford emergency expenses, that is…

any unexpected but necessary expenditure.

And, more than 50%:

May indicate that you may not have enough money for basic spending, saving and affording emergency expenses.

You can also use this calculation before you take another loan to know if…

you can afford to pay off that debt without ‘stress’.

Stay updated on our Instagram for free content, and click the button below to join the GM Free Community.

PS:

You can move from debt to freedom!

And use your earned funds to build other assets.

Money-ly Yours,

Gracing Money!

References:

1] Bank of Tanzania, Monthly Economic Review, June 2025.

2] Wells Fargo, Debt-to-Income Calculator.

3] The Richest Man in Babylon, George S. Clason

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

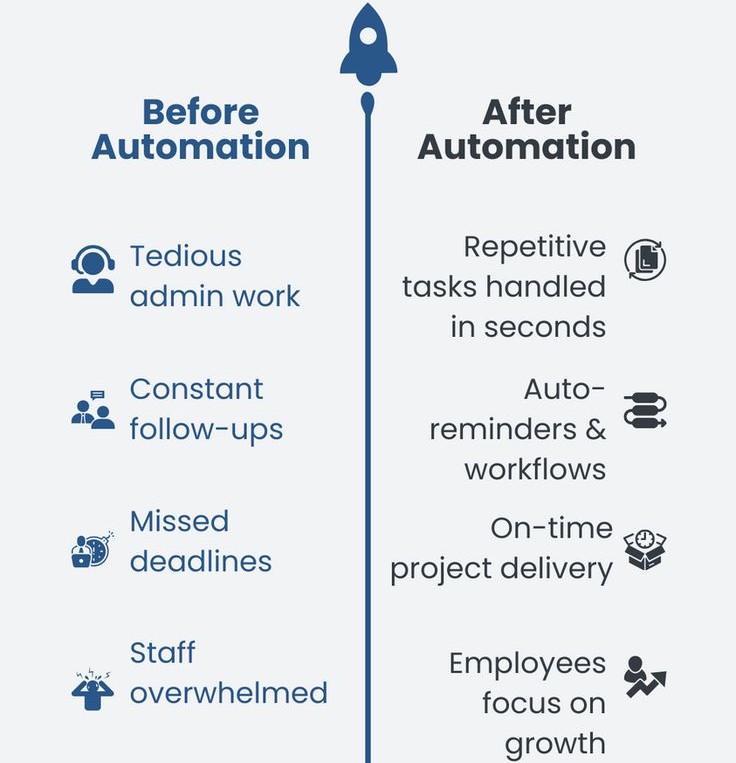

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…