Find out how to build and why an emergency fund is necessary for both personal and business use. Includes a free calculator.

You have probably ever heard this statement, ‘It’s pointless to save on a low income’.

Or maybe you probably think that there is no need to have savings for your business.

It would be really nice if challenges would give us a notification, before they happen.

But, it doesn’t happen that way.

This one saving, can also help you avoid the necessity of getting into high-interest debts,

…just because you were never prepared.

The Bank of Tanzania Report of June 2025 actually shows that personal loans are the leading form of credit in financial institutions.

In May 2025, personal loans led with 35.7% followed by business (trade) at 13.7%…

If this is what is happening, you can decide to have a savings that will make financial challenges meet you prepared,

…also for the sake of your peace of mind.

And this type of saving is an Emergency Fund. It’s the amount you have to deal with the unexpected.

With an Emergency Fund, you:

✔ Can have ample time to find another job or start a business when your income drops or cuts.

✔ Can avoid getting into debt, especially the ones with a high interest when sudden expenses for you and your business arise.

✔ Keep your peace of mind when you encounter challenges like sickness, car maintenance etc.

✔ Keep your savings pace without interruptions

✔ Make prompt decisions for necessary emergencies such as travel, tragedies and family challenges….

…and in business, you can attend to immediate needs such as maintenance of equipment necessary for operations,

also prompt decisions when opportunities arise.

✔ Avoid disturbing your long-term investments because of demanding expenses.

✔ Are able to pay your service providers, even when your clients delay paying for your services

✔ Keep the reputation of your business in service to your customers, and

✔ The reputation of your business to the staff in your business.

How to Know the Amount You Need of an Emergency Fund

First, you need to know your average monthly expenditure then multiply by the months you would want to protect your peace…

from 3 to 6 months.

If it’s a business, you will take the highest monthly expenditure as a reference, then multiply by 3 to 6 times.

And you can know the math of emergency savings right now by using the Emergency Fund Planner.

If you have never had a financial goal, an emergency fund is a great way to begin.

You can also use Mutual Funds to save.

But,

when you have collected a significant amount, the challenge you can expect is,

wanting to spend money on unnecessary expenses…

If that happens, you can protect your money by investing in liquid assets like Stocks and Bonds,

where you won’t be able to withdraw very easily.

You can read about Mutual Funds, Stocks and Bonds within the next few minutes.

Stay updated on our Instagram page for free content, and click the button below to join the Whatsapp GM Free Community.

PS:

Every 1,000,000/= has a 1,000/=, 2,000/=, and 5,000/= shillings in it. Don’t underestimate the ‘small’ figures.

An emergency fund is a savings you can’t afford to ignore!

Money-ly Yours,

Gracing Money!

References:

1] Bank of Tanzania, Monthly Economic Review, June 2025.

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

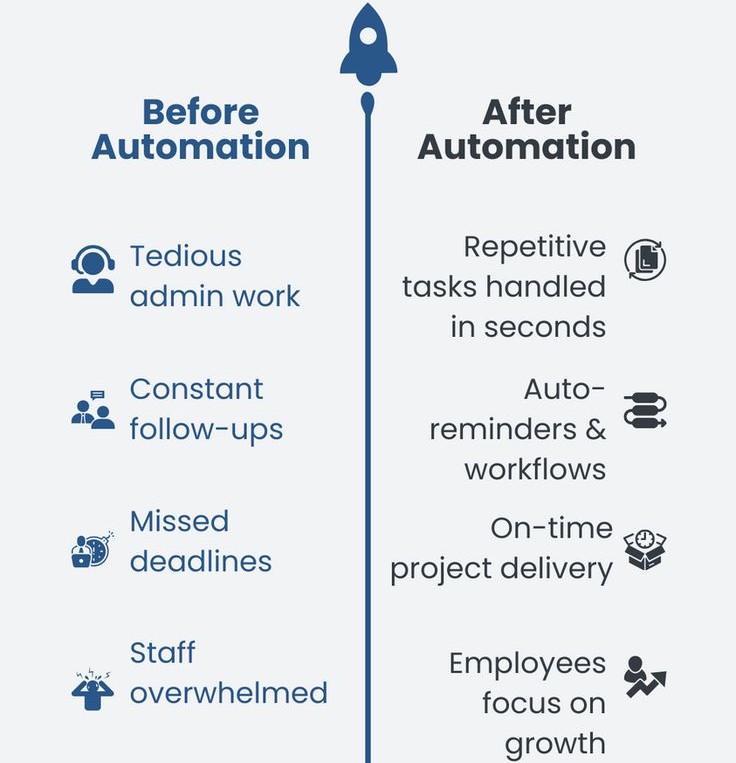

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…