Learn simple ways to budget, avoid debt, save, and track expenses even with a small income.

Lack of financial discipline is not relevant to the income you earn.

Challenges such as not having a budget, not having savings, not being enough to spend, or even a chain of debt payments is faced by…

…high-income earners and low-income earners alike.

Do you know the reason why?

It’s because financial discipline is a matter of habits. And you are the one who builds the habits, if you desire so.

The FinScope Tanzania Report of 2023 has shown that…

66% of Tanzanians find it challenging to afford the normal costs of living.

But also,

Savings is a priority after earning for only 4% of the surveyed people while,

expenses (excluding food and clothes) is a priority to a whooping 77%.

Now, without wasting your time, let’s start with…

Budget habits,

1. Distinguishing between ‘needs’ and ‘wants’

Wants are often more expensive than needs, and

…you will be more motivated to spend money on wants than on needs.

You already know that needs are essentials; food, transportation, accommodation, communication.

2. Track expenses even if it’s just once a week.

The kind of budgeting for every shilling you earn is ‘Zero-Based Budgeting’.

If you track your spending for at least a month, it is easy to know where your weaknesses are.

Example;

If your income is 600,000/= per month, you will know where your money goes when the month is over,

…where to reduce and where to improve. The numbers will give you the answers.

3. Savings BEFORE spending and not saving after spending.

On saving habits,

Example;

If your income is 600,000/= per month, set aside at least 10%, 60,000/= then start planning for the remaining 540,000/=.

It will become difficult for you to save enough once you start spending the money as soon as you receive it.

4. Avoid peer-spending; spending money to be seen or to please other people.

On expenses,

If your colleagues are going for an outing that you can’t afford, don’t be ashamed to admit it…

because it’s beyond your limits ‘at that moment’.

If other people’s contributions are beyond the 50,000/= you can give at that moment,

…there is nothing wrong with giving what you can at that time.

When you spend money for people to see, you will ache and they will not see.

5. Not using more than 30% of your income for accommodation,

If accommodation costs such as rent, electricity, water, sanitation and security are high compared to your income,

…you will struggle with other expenses.

For example;

If your income is 600,000/= and you spend more than 180,000/= for housing per month, it can be difficult…

for that income to get you through the remaining month.

6. Look for opportunities to elevate your income and have financial goals.

In other words, don’t settle for where you are at the moment.

Being pitied and complaining has never saved anyone, except getting sickness from mental distress.

So many people are born in poverty but do not die poor. If thats your background, see yourself as one of them.

There is a very good quote that says,

You are born looking like your parents, You die looking like your decisions

Go for what you desire to achieve. There is no one to do that for you but you.

7. Avoid debt by reducing non-essential spending and have savings that will help you when sudden challenges arise.

Most loans are taken for personal use, not investing nor economic productivity.

We borrow to,

✔ dress well,

✔ change interior furniture,

✔ buy exotic cars,

✔ travel,

✔ cover emergency expenses,

✔ contribute,

✔ pay school fees,

✔ give to relatives and friends who are not disciplined with their own money,

…but in all of the above, neither one earns you money.

There is nothing wrong with all the above…

but then, find a way to increase your income while doing it moderately.

Stay updated on our Instagram for free content, and click the button below to communicate with us on WhatsApp.

PS:

You are born looking like your parents, You die looking like…

It’s not too late to start!

All the best.

Money-ly Yours,

Gracing Money!

References:

1] FinScope Tanzania 2023 Key Findings Launch, 10th July 2023, Bank of Tanzania Auditorium

2] FinScope Tanzania 2023

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

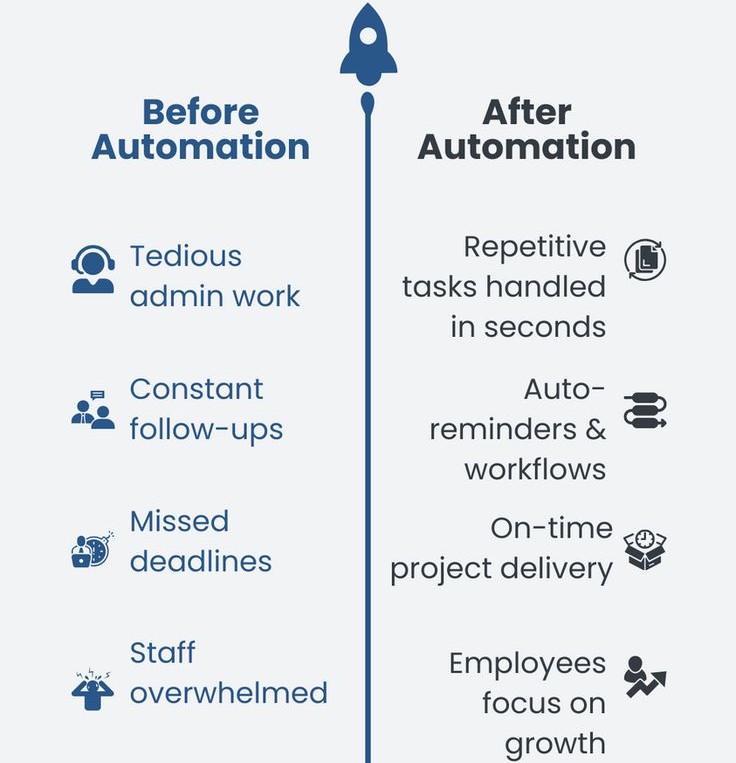

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…