for where your treasure is, there your heart will be also – Matthew 6:21 NKJV

Your spending habits show the kind of person you are…

Are you used to meeting people’s needs and wants?

Or are you an investor? Do you value savings?

Maybe you love to have fun, attend parties, beauty, decors, electronic gadgets…

Your daily expenses will say it all.

The FinScope Tanzania Report of 2023 has shown that…

expenses (excluding food and cloths) are people’s payments priority when they get money by 77%,

while savings payments is a priority for 4% of the surveyed people.

Your expenses show:

1. Your Priorities

Your initial expenses and your major money expenses of the money you earn shows what is actually important to you;

It could be eating well, paying off debts, buying clothes, taking care of your family, entertaining friends,…

dining out, saving for your needs, developing your business etc.

2. Your Power to Save and Invest

It is the percentage of your income that goes to your future,

✔ Emergency Savings

✔ Retirement Fund (not pension plans like NSSF, PSSSF)

✔ Building a House

✔ Investing in Financial Assets such as Stocks and Bonds.

Your expenses will show if you save, don’t save, save a little than you should,…

or that as your income increases, which between expenses or savings actually increases.

3. If Your Income Is Low, Sufficient, or Not Managed Well

If your monthly income is used only for basic expenses and there is no extra, then your income is low compared to the actual life costs,

but it is also possible that your income is sufficient but does not give you the opportunity to fulfill all your financial goals,…

or you have a good income but you don’t manage it well.

Assess your income based on your basic spending, savings, and financial goals to know how you will need to increase your earning power,

so you can live the life you want.

4. Your Money Discipline

Do you care about savings?

Can you say ‘no’ to expenses that do not match your goals?

Can you say ‘no’ to those friends who ask you for money and never give it back?

Are you directing your money to develop your business, investments, and financial goals as you intended?

Your ability to say yes or no determines where your discipline is.

5. Which Decisions Ruin Your Budget

It could be,

✔ Emergency Expenses

✔ A Chain of Debt, or

✔ Meeting the needs and wants of family and friends

If you track your expenses for at least a month, it becomes easy to know which decisions actually ruin your budget.

6. Which Financial Mistakes Are Your Spending Habits

As we mentioned earlier,

Expenses are a product of habits. If you have goals that you never reach, it’s good to know which behavior needs changing on your part.

For example, if the following challenges are normal to you;

✔ Emergency Expenses ~ then build a habit of prioritizing savings

✔ Having a Chain of Debts ~ escape a life of living on loans

✔ Serving Family and Friends ~ meet needs in your capacity and learn to say ‘no’ when necessary

Changing habits is no easy task, especially your own spending habits. So be patient with yourself and have someone to hold you accountable.

7. Which Situations Push You to Unplanned Expenses

Careless spending may not be your habit, but circumstances that happen from time to time.

It could moments of,

sadness (you will buy what you love to make yourself happy),

happiness (you will spend more to elevate the happiness),

anger (you will buy what you love to get some sort of relief), or maybe…

shame (you don’t want to be humiliated in front of your partner, friends or family: even if you don’t want to spend your money that way).

In times of sadness, anger, and shame, we use money to get a sense of relief for what you feel though.

it does not solve the reason for that situation to exist.

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

A building constructed for three (3) years can completely burn down within 60 minutes,

…that’s just how easy it is to run out of the money that took you a long time to earn.

Knowing and paying attention to your spending habits is important!

…for you and for me too.

Wishing you success 🙂.

Money-ly Yours,

Gracing Money!

References:

1] FinScope Tanzania 2023

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

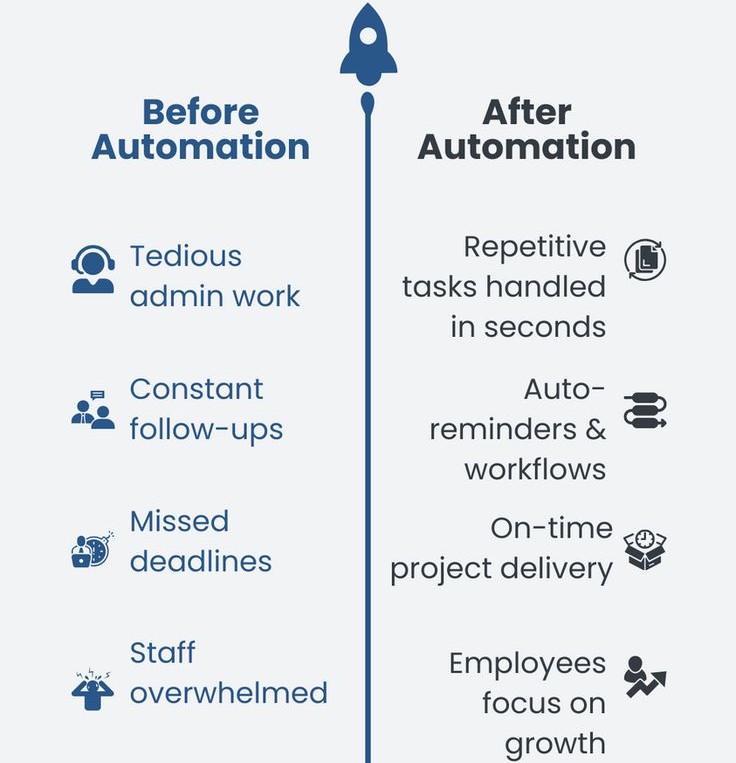

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…