It is the kind of education that we never received from kindergarten,

…or even found it at the family level,

and very few places of worship have given its people the opportunity to learn.

Then we finish all the levels of education, only to come back to this very thing.

Money, cash, however you want to call it…

We come back to personal finance.

Because the lifestyle you want to live is what will push you to make important money decisions,

about yourself, people who depend on you, and even your friendships.

That is, the way you will relate to the whole community.

The most important things to consider in your finances are;

✔ Knowing Yourself,

✔ Knowing Your Money,

✔ Managing Yourself, and

✔ Managing Your Money.

The book, The Richest Man in Babylon by George Clason has summarized the basics of personal finances, in what the author named as the…

The 7 Cures of a Lean Purse.

These 7 money management principles are a perfect money guide for young adults under 40.

The first is to save at least 10 percent of your income.

In simple language, don’t spend everything you get and don’t spend more than you earn.

If you are spending more, it means that you are already entering into the ignition of non-productive debts.

Then control your spending.

Learn to distinguish between basic needs and non-essential expenses so that you can spend less than you earn.

Thirdly, make your savings produce more money, that is…

Invest your savings to generate additional income through businesses or resources that will generate profits.

Non-productive savings will not do you any good. Keeping your money this way will tempt you to use it.

Four, protect your money from the risks of loss.

Avoid entering into risky businesses that have a big possibility of losing than winning, no matter how tempting.

Do your research before investing or getting involved in any business, and remember that…

it took you much energy and time to earn the money that can be lost in a short amount of time.

Then, own your residence.

Having your own residence will give you peace of mind and eliminate some unnecessary expenses, but…

don’t forget that the house is for you and the family and is not an income generating asset,

unless it is a rental property.

Six, make sure you secure a future income.

Invest for your old age and the future of your family. Aim for future financial security.

And lastly, improve yourself professionally or in skill,

…in the work you do to increase your income through your employment or business.

Understanding these is a good start on how to control your finances, and you can read here,

…to understand more about budgeting, saving and expenses.

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

Don’t forget that this all starts with how you choose to use what you earn.

Your goals will then tell you whether your income is sufficient or not, and…

it’s not too late to start!

Money-ly Yours,

Gracing Money!

References:

1] The Richest Man in Babylon, George S. Clason

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

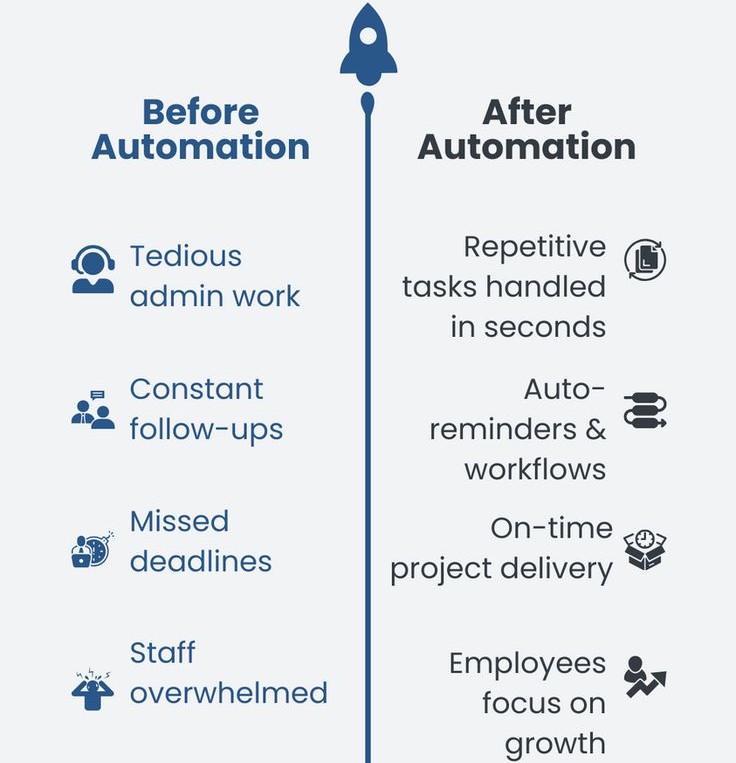

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…