You don’t need pricey stocks to win big in investing. Here are 5 reasons why (for your benefit).

You have probably heard about investing in stocks,

…and you know that a stock is the ownership of part of a company or business, and that

shares have different prices according to the respective companies.

However, you do not know how share prices are related to the profit you will make.

If you are in this situation, this writing was written for you. Read to the end!

But before we continue,

you might want to review the introduction to investing in stocks.

So on 4th of July, 2025,

companies in the Dar-es-Salaam Stock Exchange (DSE) that sold and bought shares,

…had share prices ranging from 145/= (DCB Commercial Bank) to 16,010/= (TCC: Tanzania Cigarette Company – Sigara), for one share.

The two main advantages of investing in stocks as you already know;

are capital gain and dividend income.

Your money grows from the increase in the stock prices and you get dividends from the company’s profit in that financial year.

Now coming back to our main topic, we will address some stock market myths, and answer the question,

‘Do you need expensive shares to profit from stock investing?’

So, first;

1. Stock Prices Do Not Directly Indicate Future Profits

The profit you will get if you invest in stocks, if dividends and/or capital gain depends on,

The capacity of that company to use its capital to make a profit, and

the profit the company generates before interest and tax deductions.

A stock may have a ‘low’ or a ‘high’ share price but if it does not generate sustainable profits over a period of time,…

you, the investor, will not get sustainable profits either.

2. Your Analysis Before Investment Is Your Reality Check

Along with getting a basic knowledge on stocks investment, you will have analyzed a company based on the,

✔ Quality (Qualitative Analysis), and

✔ History of Income, Profits, Debts, etc. (Qualitative Analysis)

Therefore, the stock price may have a low price or a high price but if the company does not have a good leadership,…

or its level of debt has exceeded its actual revenue greatly,..

…then the possibility of getting dividends or the stock price growing decreases.

3. The Share Price May Be More Expensive Than The Book Value

Each company has a real value (Book Value) which is its total assets minus all its debts.

Changes in the stock price may cause a share to be;

✔ less than real value ‘underpriced’,

✔ of average value ‘fairly priced‘, or

✔ have a high value ‘over priced’,

at that time.

Therefore, the stock price may seem ‘cheap’ but could be expensive relative to the real value of the company.

4. A Company May Fail to Pay Dividends Despite Making Profit

Every company has its own dividend policy, meaning

‘Company A will give A% of its profits as dividends to investors.’

But, dividends still come from the profit made.

If the company decides to return all that year’s profit back to the business for growth purposes, the investors will not get the dividends.

5. Share Prices of a Company May Not Change in a Long Time

Share prices rise due to the positive expectations of investors in the market (the demand and supply).

As the demand of a company stock grows, the stock price increases.

But, it may come time that the price does not change, because;

✔ The ‘demand’ for particular stock is decreasing, or

✔ The company has grown to the extent that it mainly focuses on paying dividends to the investors.

If the stock price does not change, you will not enjoy any capital gain.

And if you prefer another type of investment, you can read through Mutual Funds and Bonds.

Stay updated on our Instagram for free content, and click the button below to join the WhatsApp GM Free Community.

PS:

The minimum amount for you to start in stocks is only 10 shares! You don’t need millions to get started.

Money-ly Yours,

Gracing Money!

References:

1] Dar-es-Salaam Stock Exchange, dse.co.tz

2] Dar-es-Salaam Stock Exchange Market Report, Friday, 4th July 2025

3] The Little Book That Still Beats the Market, Joel GreenBlatt

Follow us on Socials

Read More Blog Posts

The Five (5) Questions You Already Have About ETF Investments

Its a new market place, yes…but worth knowing about it You have probably heard about ETFs but you don’t know what…

UTT: What It Is and How You Get Started

Curious about UTT? Learn what it is, how it works, and how to begin investing in it. You may have heard…

How to Participate in the Financial Market, as a Muslim,

A Muslim’s Guide to Participating in the Financial Market in a Halal and Faithful Way You’ve been hearing about investing a…

Magoroto Travel

My first solo travel…and now, I want it to be a lifestyle 😋 DAY 1 The sunrise met me on a mountain…

Is Investing in NICOL the Right Decision?

Is investing in NICOL the right decision for you? Know all about NICOL in just a few minutes. On the snapshot…

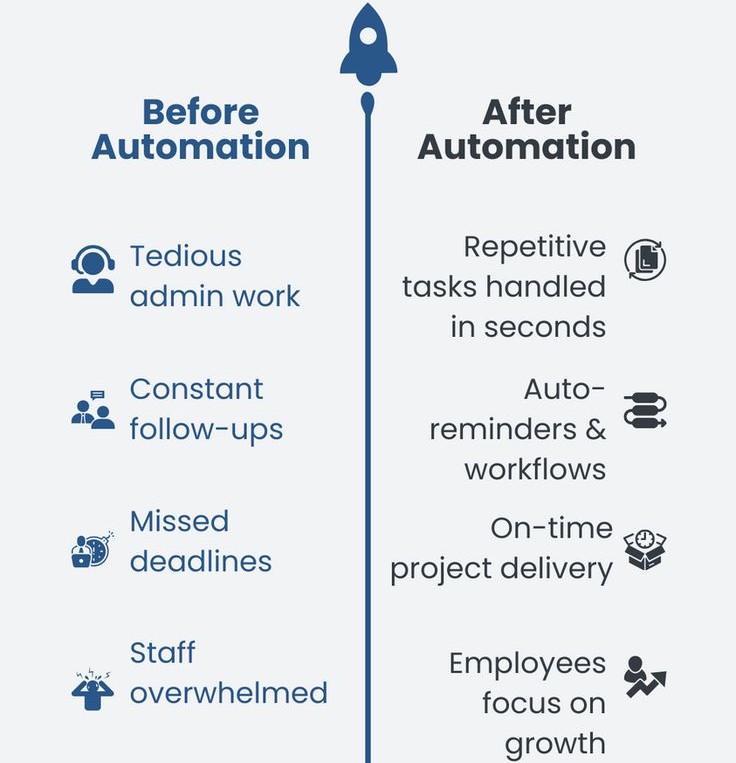

How to Operate Your Business WITHOUT LOSING Your Time

Scroll to the end if, you have a service-based business or a brick-and-mortar business (for physical products), but you experience the following pains; ✔…